How can we lower the traditional barriers to investing, making it accessible for all?

I was the sole designer on digiPortfolio, a 0-to-1 product that was DBS’s inaugural entry into the robo-advisor space. Working in a 20+ person cross-functional team, I executed the end-to-end design, guiding the business team through the design process.

The final design received positive reviews and enabled the business team to hit their AUM targets and diversify DBS’s investment product offerings.

My contribution:

Sole designer in project team of 20+ comprising of business, engineering, compliance, external vendors

Introduced business team to UX writing & design ideation, facilitating the hiring of a freelance UX writer and illustrator

Defined design direction and executed design, from project inception to pilot launch

Led design workshops and discussions with project team, presented to senior stakeholders

Collaborated with UX research team, co-scoping out research objectives and test materials

Created scope and oversaw work of freelance UX writer and illustrator

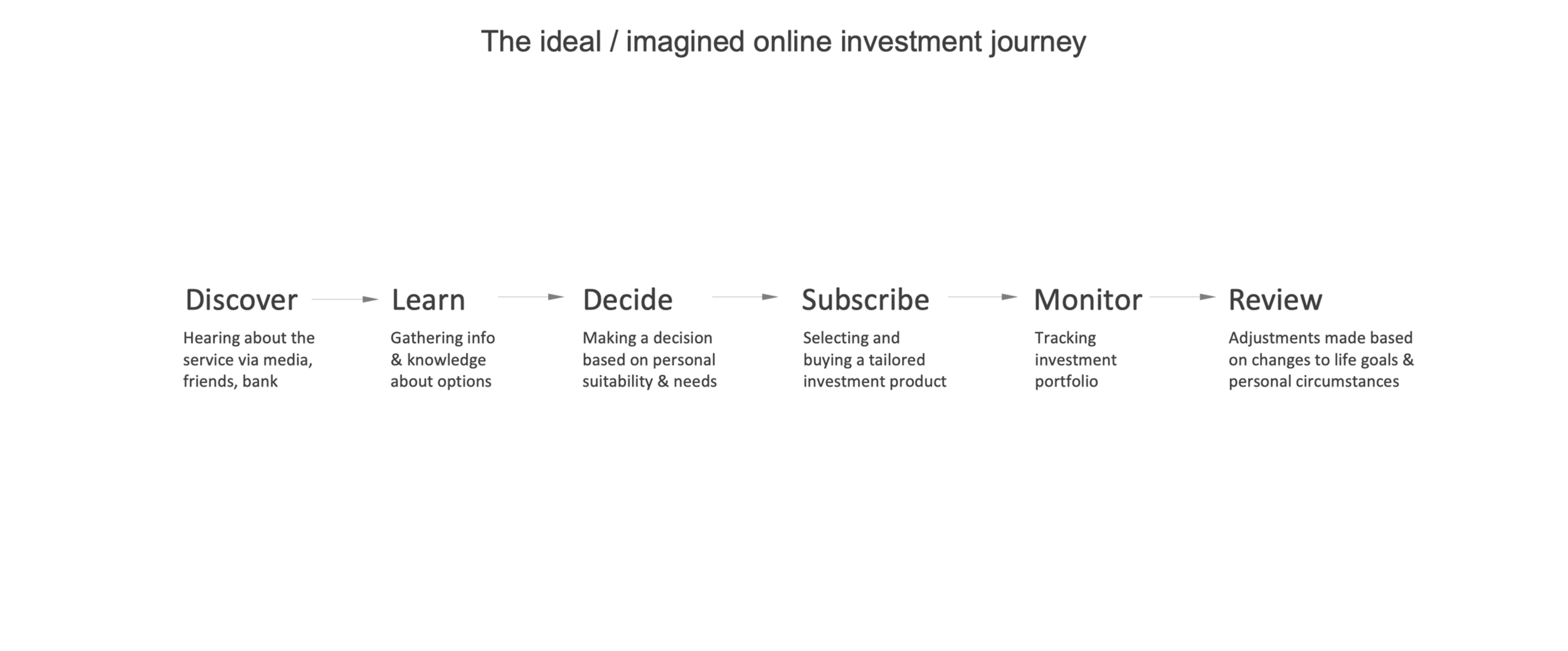

Aligning expectations & objectives

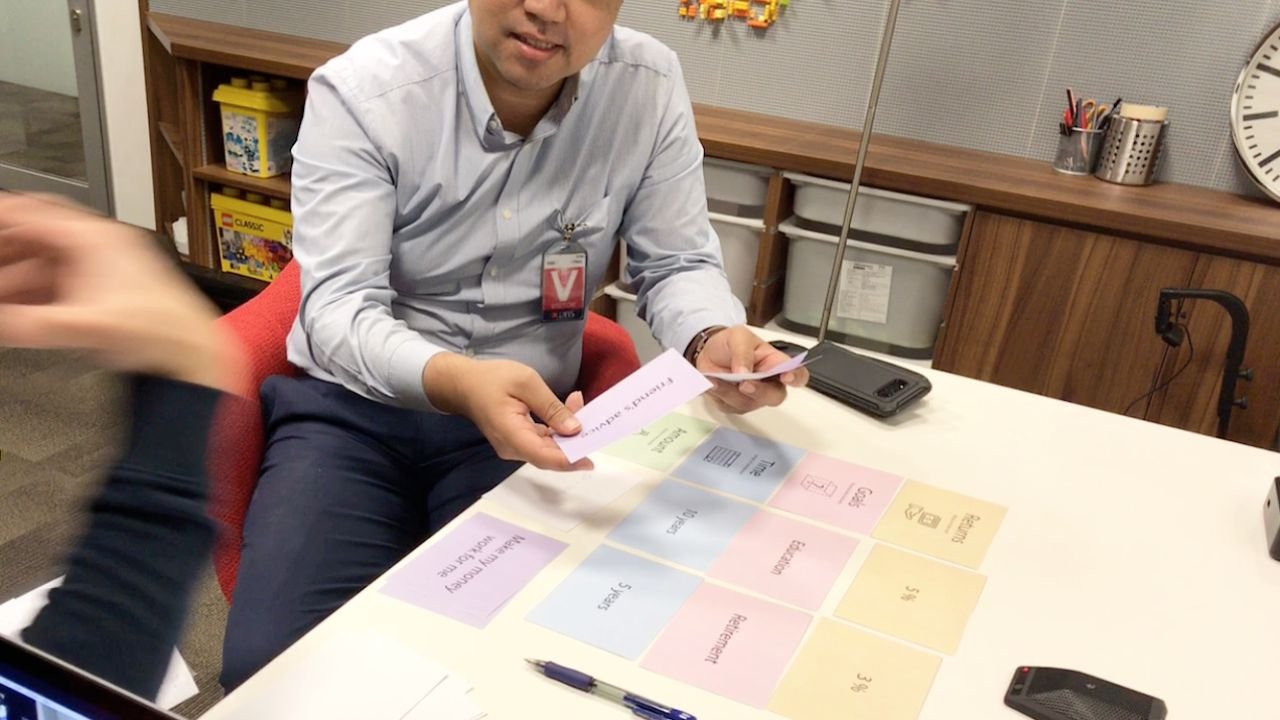

During the project inception phase, I conducted several design exercises to align the project team (20+ people across business, tech, external solution providers) towards common goals for the user experience.

This helped them visualise the interconnected parts and provided clarity and definition at the start of the project where many parts were still moving.

This enabled us to chart a preliminary journey map that identified potential gaps and pain points to validate with customers.

We got it wrong (and we’re glad we did 🙂)

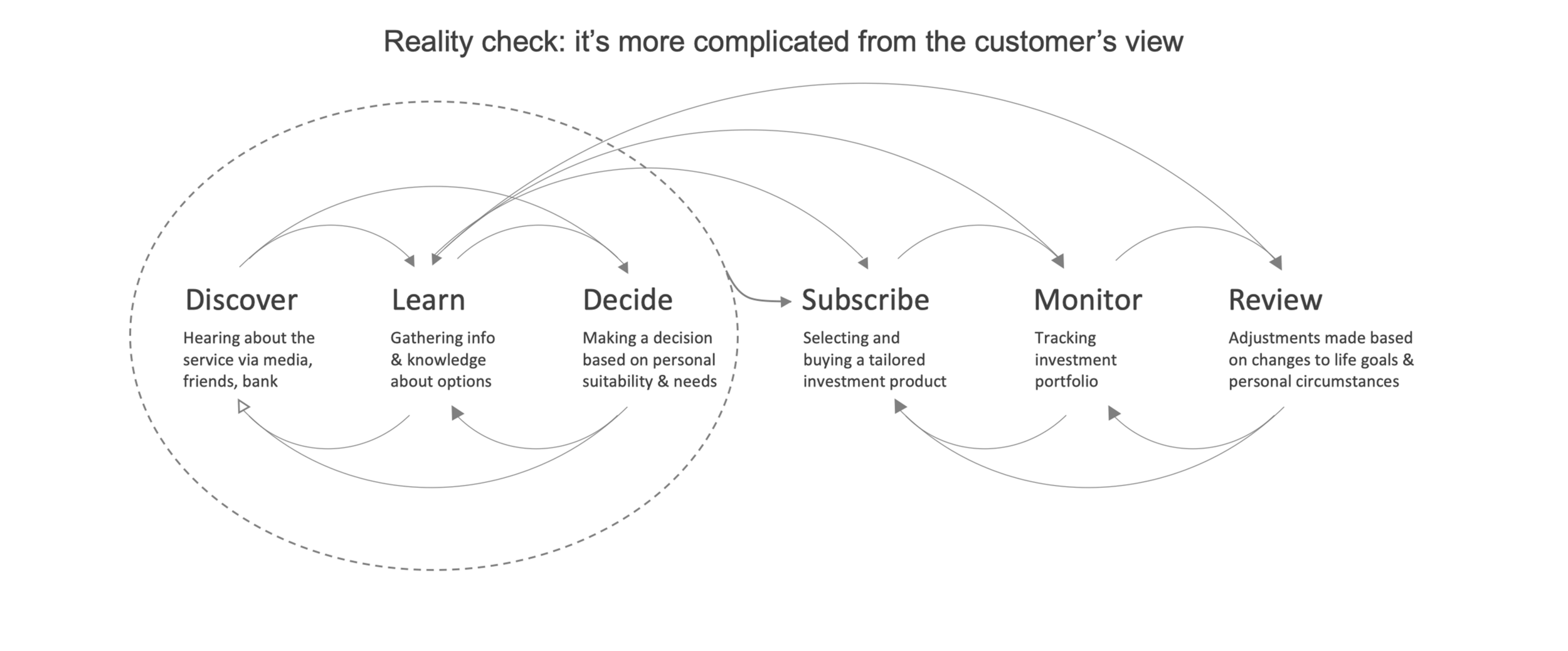

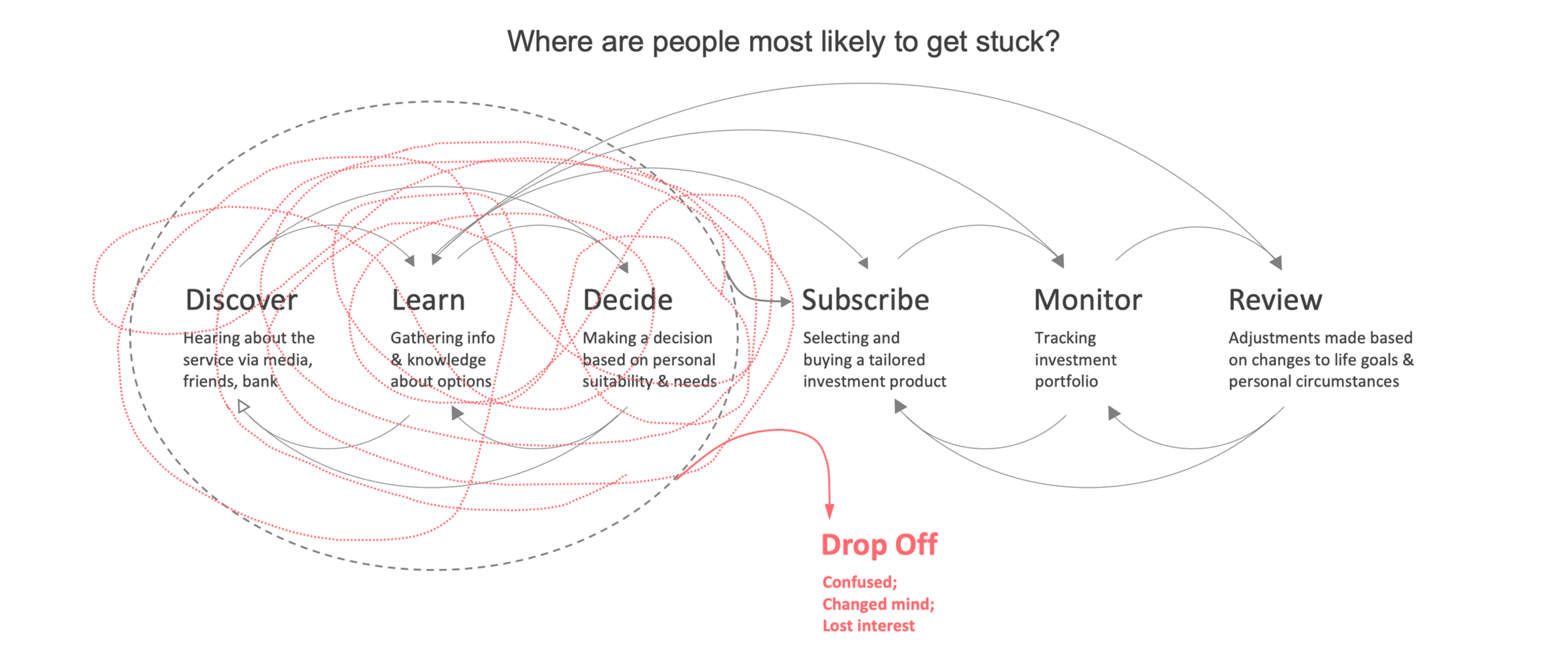

Through generative research sessions with customers of different levels of investment knowledge, we learnt that the investment journey is much more dynamic and back-and-forth than we thought.

This biggest hurdle was at the start, where they needed various types of validation to feel assured they were making the right choice.

Early concept: Questionnaire to create a personalized portfolio

Early concept: Build your own portfolio

The typical conventions employed by other robo-advisors also didn’t test well. Customers felt there were too many options – a case of analysis paralysis.

There was also the fear of missing out, afraid that how they answered the questions would limit their options, and in consequence affect their potential returns.

Set menus

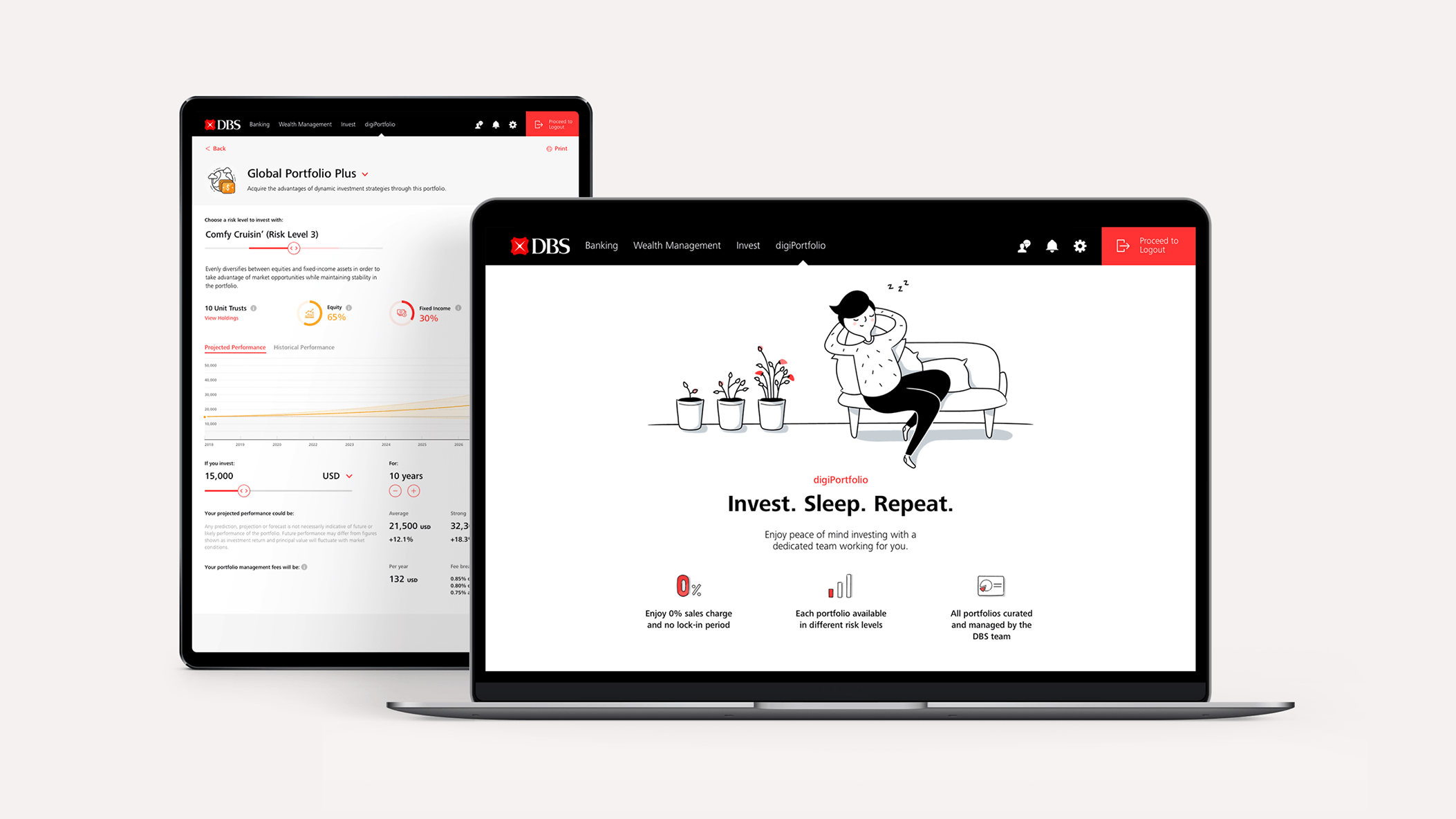

We went with the mental model of a set menu, curated through the expertise of our DBS Investment Team.

This tested better with customers as they were able to see all the available options and felt in control to choose whichever they felt more comfortable with.

Open navigation

We used an open navigation structure that allowed customers to go back and forth between different sections, empowering them to commit to a portfolio at their own pace.

This aligned to their behaviours on wanting to gather information and opinions from their trusted sources before commiting.

Establishing a clear visual metaphor

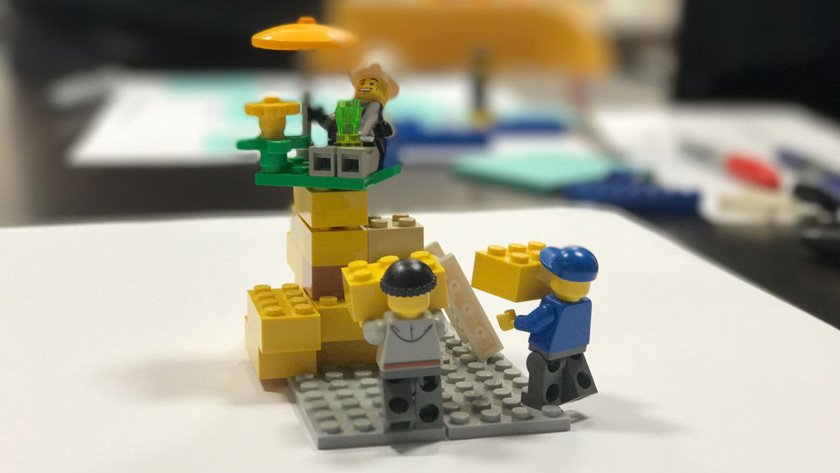

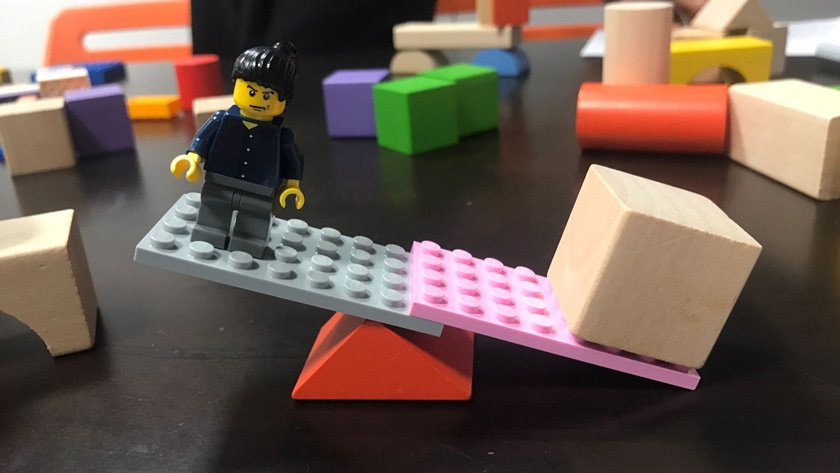

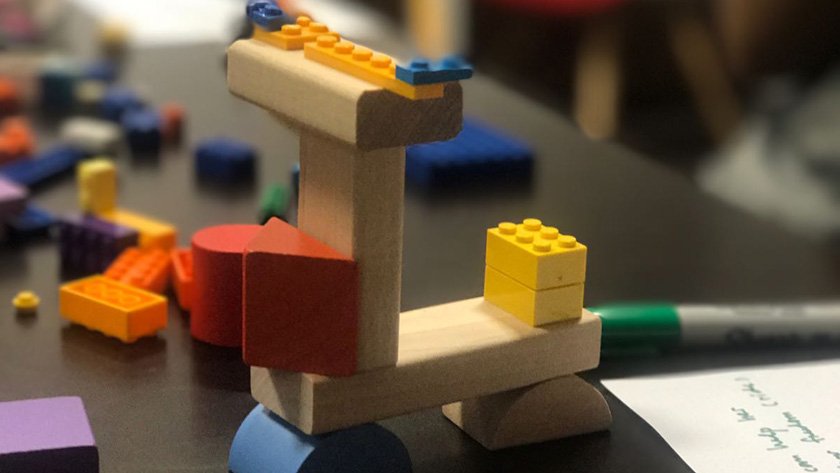

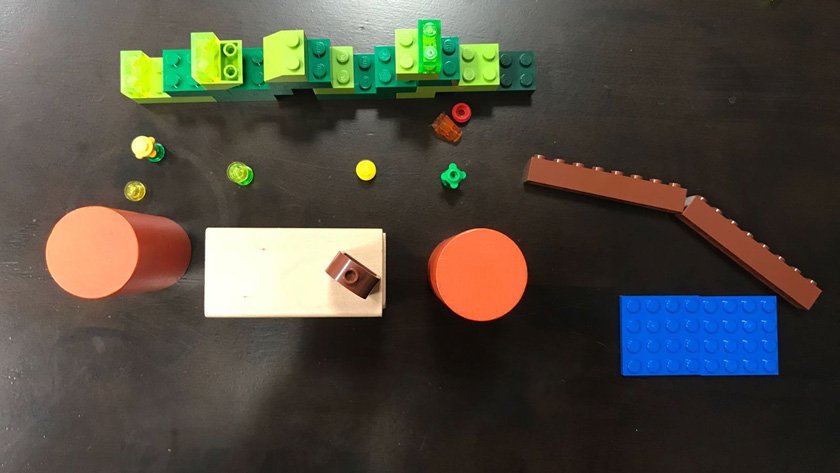

I facilitated a lego building exercise with the design and business team to help us uncover what visual metaphors we could use to communicate digiPortfolio’s unique value proposition.

The prompt was simple:

Build something that represents what financial independence means to you

Pass it to the person on your left

With artifact you received from the person to your right, add on something that represents how investments can help

Invest. Sleep. Repeat.

We eventually settled on the metaphor of plants – there are many variety of plants, and many ways of growing them. With digiPortfolio, we help you select the best plants (investment products) for you and cultivate them (monitor & grow your portfolio) so it bears fruit (returns).

This concept was easily understood and could be applied across the different cultures in our various markets too.

Illustrations done in collaboration with Studio Ryn & Wo

We select the best investment products for you

Investing made smart & easy

We do the hard work for you

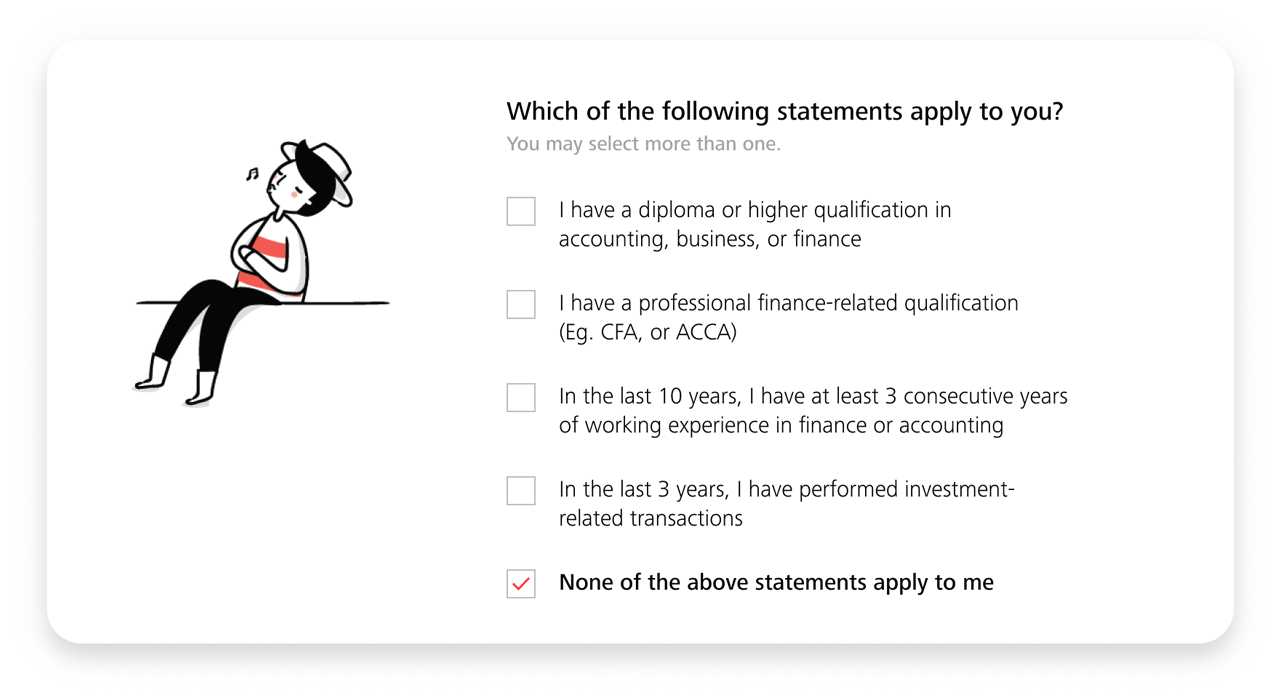

Expanding the visual universe to make investing fun and easy

We expanded the universe of Illustrations that Studio Ryn & Wo did into other areas of the product, creating a fun and approachable persona that was also in line with the larger DBS brand.

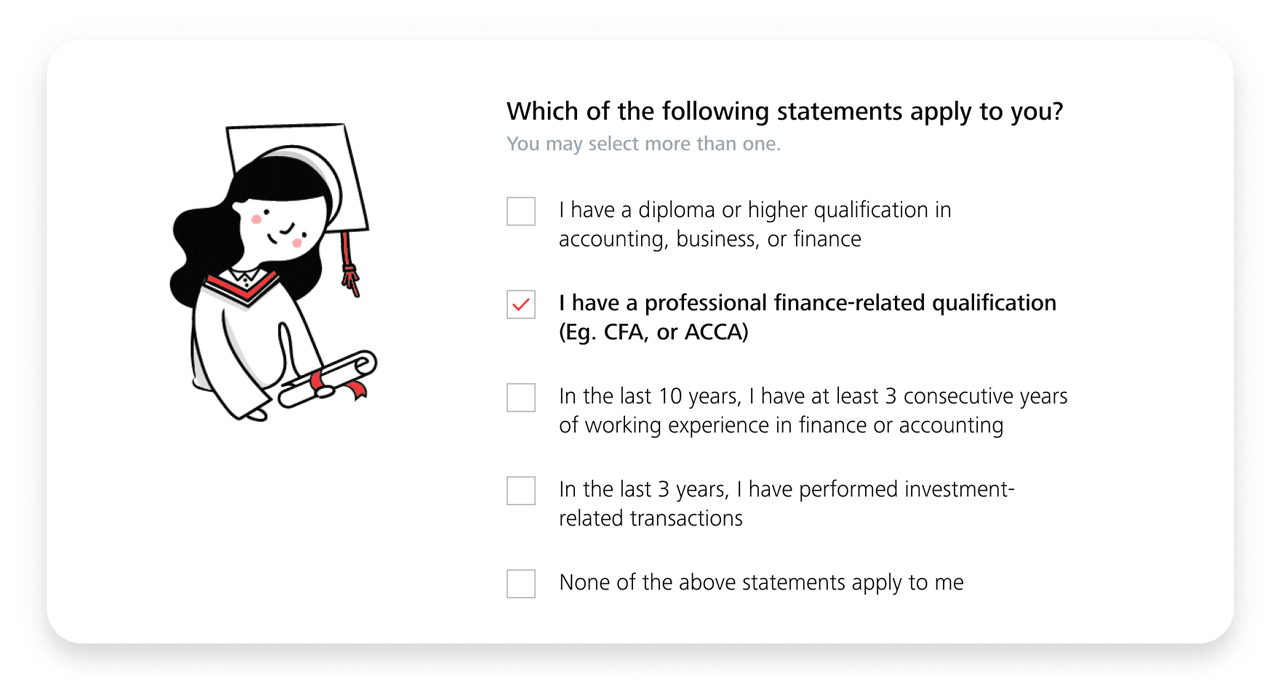

Investment knowledge assessment

Portfolio loading screen

Building transparency, trust, assurance

Our customer immersions revealed that transparency around fees, holdings, and performance were key to building trust and increasing their likelihood to invest.

This was an uncomfortable proposition for the business team as transparency meant revealing potential weaknesses or disadvantages. Still, we pushed for it.

We created small but impactful features that build continual trust and assurance, placed directly in the context of where they were needed most.

For example, sharing the team’s decision behind a holding’s selection within the holdings list itself, or positioning a space for quarterly commentary directly below the performance graph.

Our decision to challenge the aversion to transparency eventually paid off when digiPortfolio launched.

It gained positive reviews from various finance blogs in Singapore, validating our earlier decision.

Links to the reviews: MoneySmart / Dollars & Sense

Designing in PowerPoint (empowering the business team)

Our customer immersion revealed that the Fact Sheet was a key document customers would study before making any investment decision.

Knowing this was a key component, we helped the Investment Team to design digiPortfolio’s Fact Sheet using the existing template they had.

Our redesigned fact sheet & FAQ

The fact sheet was designed and executed on PowerPoint. This was needed as the graphs had to accurately portray calculations from Excel.

Working within Microsoft Office also meant that the Investment Team could directly consume the file and use it to make their quarterly updates on their own, simplifying our workflow.

Overall impact

Through the work we did over the course of 9 months, the digiPortfolio product team was able to launch DBS’s inaugural entry into the robo advisor space at the start of 2019.

While the exact numbers are confidential, digiPortfolio has been able to amass a sizable amount of assets under management (AUM) since its launch, successfully diversifying DBS’s investment offerings and meeting larger strategic targets.